Category: Markets

January 28th, 2017 by geoffhodgson1946

Geoffrey M. Hodgson

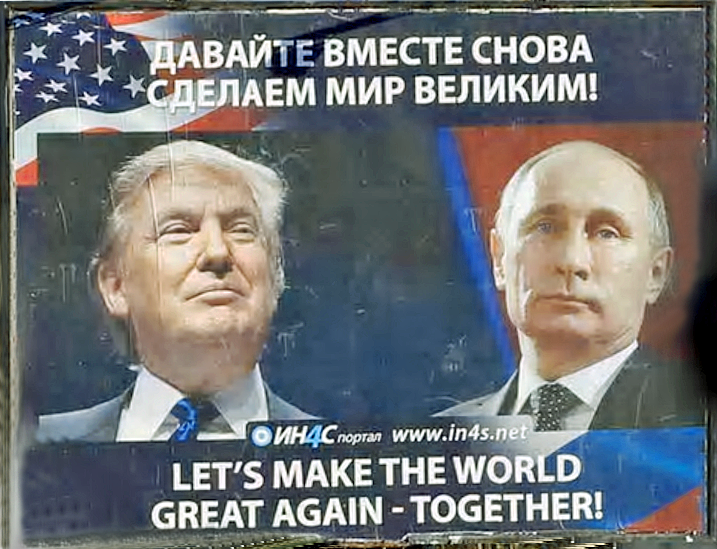

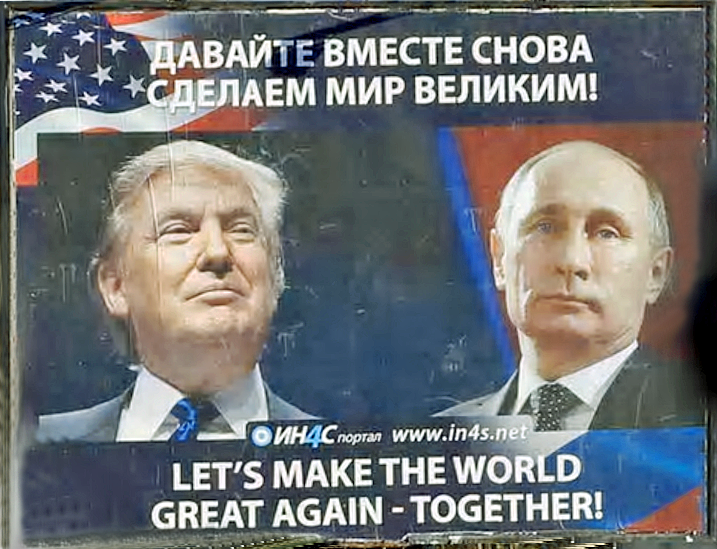

The political earthquakes of 2016 are probably the beginning of a series of major ruptures in world politics. Donald Trump was elected in the USA, Britons voted for Brexit, Turkey lurched toward dictatorship, Brazil ejected a democratically-elected president, Russia extended its global influence, and China tightened internal security while building military bases in the South China Sea.

From America to Asia, authoritarian nationalism is on the march. The future of old alliances is cast in doubt, raising a renewed spectre of global war.

These seismic changes should prompt us to reconsider our priorities. Is ‘neoliberalism’ – whatever that means – our main enemy? Or is it rising authoritarianism and nationalism instead?

We have been here before, albeit with much less dangerous military weapons. The rival imperialisms of the nineteenth century led to the First World War. Collapsing imperial dynasties triggered revolution in Central and Eastern Europe. Communists successfully seized power in Russia in 1917. Post-war political and economic turbulence led to the triumph of fascism in Italy, Germany and Spain. Imperial Japan invaded nationalist China.

I am not suggesting that history will repeat itself in the same way. But it is important to understand how the tectonic plates of political change affected the way we understand and map political positions, and the way in which we prioritise political issues.

The thirty-year squeeze (1918-1948)

Europe suffered economic depression for much of the interwar period. The financial crash of 1929 exacerbated the crisis and led to a collapse of world trade. Liberal defenders of the market economy were put on the defensive: capitalism seemed at the end of its tether.

Beatrice & Sidney Webb

Meanwhile, some intellectuals from the USA and Britain – including Labour stalwarts George Bernard Shaw and Sidney and Beatrice Webb – visited the Soviet Union brought back glowing accounts of an expanding economy and a joyful population. (The Soviet propagandists explained away disasters such as the Ukranian Famine as resulting from sabotage by rich peasants or foreign agents.)

With the crisis of capitalism, the rise of fascism and the apparent success of Soviet Russia, many British and American radicals became Communists or fellow travellers. For them, liberalism and the defence of the market economy seemed a weak or unviable option.

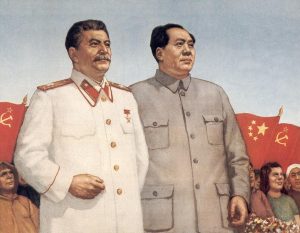

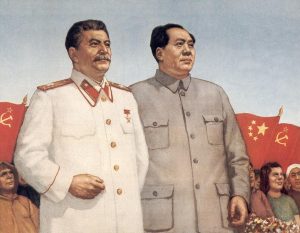

The choice seemed to be between two forms of authoritarian government: much better the one that proclaimed equality and opposed racism. (But in reality, the Stalin regime promoted antisemitism, genocide against several other ethnic minorities, and dramatic internal inequalities of power.)

Stalin, Roosevelt and Churchill in 1941

The alliance between Russia and the West in the Second World War smothered criticism of what was really going on within Stalin’s regime. But, with the beginning of the Cold War in 1948, socialists were forced to make a choice between either supporting an antagonistic and undemocratic foreign power, or aligning with the USA and its allied democracies.

Labour under Clement Attlee aligned with the West. But rose-tinted visions of Soviet Russia or (from 1949) Mao’s China lived on among he Left.

In major European democracies, the thirty years between the end of the First World War and the start of the Cold War had seen liberalism squeezed, between socialism on the one hand, and reactionary authoritarianism on the other.

‘American imperialism’ and the rise of neoliberalism

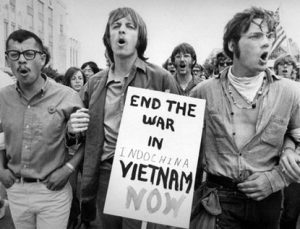

Things were different in the USA, which polarised between forms of Republican conservatism and Democratic liberalism. But rising tensions in the Cold War, and the eruption of the Vietnam War in the 1960s, made American-style liberalism less attractive for the global Left.

Marxist-led national liberation movements in Cuba, Indochina and elsewhere kept the collectivist vision alive for the Left around the world. Liberalism was see as the fake ideology of American imperialism and the global bourgeoisie.

Marxist-led national liberation movements in Cuba, Indochina and elsewhere kept the collectivist vision alive for the Left around the world. Liberalism was see as the fake ideology of American imperialism and the global bourgeoisie.

Some have argued that neoliberalism was reborn in the 1970s, when conservatives such as Ronald Reagan and Margaret Thatcher adopted a vision of expanding markets and a contracting state. Although the Left could never agree on what ‘neoliberalism’ meant, they mostly agreed that it was the main enemy.

Much of the Left, throughout the world, had never got rid of its agoraphobia – its fear of markets. Private enterprise and market forces were always and everywhere seen as the problem. Liberals, who defended private property and markets as well as human rights, were mocked as the bourgeois enemy.

Our brave new world

But the global tectonic plates are now shifting abruptly, in an erupting national and international crisis, as big as anything since 1948.

Nationalist leaders strut around the world stage. They stock up their nuclear and conventional arsenals and jostle for geopolitical advantage.

Torture is endorsed. Journalists are threatened or imprisoned. Scientific findings on climate change are denied. Intellectuals and experts are ridiculed. Ignorance and dogma are celebrated. Truth is swamped by lies. Legislation protecting workers and the poor is undone. Minorities are attacked and made scapegoats. Racism is given licence. People suffer discrimination on the basis of their religious or other beliefs. Democratic systems are damaged. Judges and lawyers are treated as traitors. The rule of law is undermined.

In this dangerous new world, it matters less whether that railway is nationalised or whether water distribution is in public ownership. Forms of ownership are always secondary to the actual provision and distribution of vital goods and services. But when our rights and liberties can no longer be taken for granted, questions over forms of ownership move even further down the ranking of priorities.

The ubiquitous, trivialising idea that the Left is defined in terms of public provision, and Right as private provision, is historically recent and a gross reversal of their original meanings. It is also a polarisation of lesser relevance in this world of rising authoritarian nationalism.

Our fundamental rights, our liberty, and the rule of law are now increasingly threatened. Their defence becomes the great struggle of our time.

This lesson is hardest for Americans and Britons, who were spared domestically from the jackboots of twentieth-century despotism. Struggles for British and American national liberty are beyond living memory. We have grown fat and lazy on the fruits of the liberal order. We have taken for granted its institutions and underestimated their fragility. We must repair our vigilance.

The liberal opportunity

For 100 years, for the reasons given above, liberalism has been marginalised. Now is its opportunity – indeed its urgent necessity.

Unlike our grandparents in the crisis-ridden 1930s, we have seen the socialist experiments of the twentieth century and counted their cost at 90 million lives. History and social science have more to teach us. If we wish to learn, we can know more about how markets work. We can understand the informational, organisational and other impediments to comprehensive national planning. We can appreciate why countervailing politico-economic power, based on a strong private sector, are necessary to buttress democracy and resist authoritarianism. The twentieth century has taught us these lessons.

The old Marxist mantra of bourgeoisie versus proletariat is also ungrounded in reality. Instead we have a highly fragmented working class, much of it enduringly aligned with authoritarianism and nationalism. Marxism relies on a quasi-religious and nonsensical belief that the working class – whatever it actually believes or strives for – carries our human destiny.

Class struggle has mattered, but it has never been the main motor of history. What have mattered more have been struggles for power, by individuals, dynasties, nations, religions or ideological movements.

The Storming of the Bastille in 1789

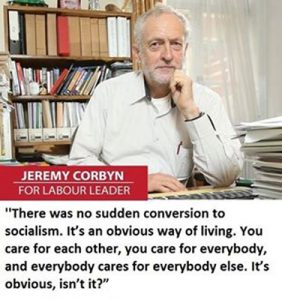

Liberalism was one of those movements. Based on the imperatives of equality and liberty, it matured in the Enlightenment.

Liberalism rose up in the English Civil War of the 1640s, in the American Revolution of the 1770s, and in the French Revolution of 1789, in titanic struggles against despotism and oppression.

Now, once again, liberalism is centre stage, as the enemy of authoritarian nationalism.

The liberal rainbow

Its allies are not those who pander to authoritarianism by eroding civil liberties, or do the spadework of the nationalist Right by making immigration (rather than assimilation) a foremost problem. The prime allies of liberalism are all those who defend liberty and human rights. But therein lies a concern, which must be discussed.

From the beginning, liberalism has harboured different views on the role of the state and of the degree of state intervention required in the economy and society. On the one hand there are liberals – sometimes called libertarians – who wish to minimise the role of the state.

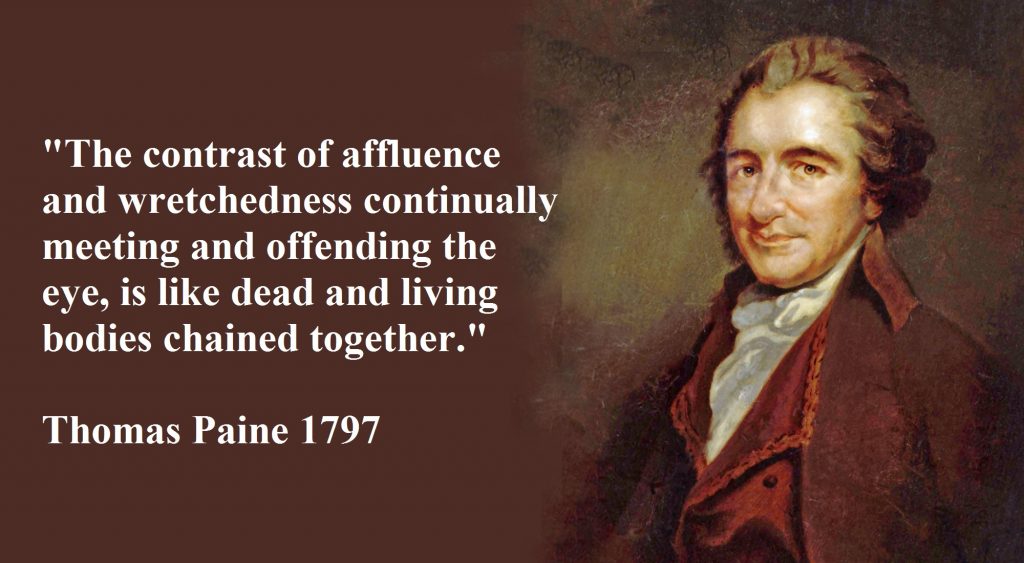

Thomas Paine

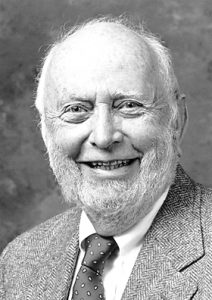

John Maynard Keynes – another great liberal – argued that state regulation of financial markets and counter-cyclical expenditures are necessary to stabilise the capitalist system. Keynes showed that economic austerity is a flawed doctrine. Government deficits are best reduced by growth: budget cuts can contract the entire economy and make the problem worse.

There is a spectrum of views between individualist and social-democratic liberalism, but all liberals are united in their defence of individual liberty, human rights and political democracy. The diverse colouring of this rainbow does not diminish its united opposition to the dark intolerance and division that is exacerbated by authoritarian nationalism.

The struggle for liberty and equality has always been vital. But many twentieth-century radicals were diverted by the delusions of socialism. The renewed rise of authoritarianism has shown us again that liberalism is the vital political movement of the modern age.

28 January 2017

Minor edits: 29 January, 1, 16 May 2017

|

This book by G. M. Hodgson elaborates on some of the political issues raised in this blog:

Wrong Turnings: How the Left Got Lost

Published by University of Chicago Press in January 2018

|

Bibliography

Allett, John (1981) New Liberalism: The Political Economy of J. A. Hobson (Toronto: University of Toronto Press).

Beveridge, William (1944) Full Employment in a Free Society (London: Constable).

Clarke, Peter (1978) Liberals and Social Democrats (Cambridge: Cambridge University Press).

Claeys, Gregory (1989) Thomas Paine: Social and Political Thought (London and New York: Routledge).

Courtois, Stéphane, Werth, Nicolas, Panné, Jean-Louis, Packowski, Andrzej, Bartošek, and Margolin, Jean-Louis (1999) The Black Book of Communism: Crimes, Terror, Repression (Cambridge MA: Harvard University Press).

Hodgson, Geoffrey M. (2015) Conceptualizing Capitalism: Institutions, Evolution, Future (Chicago: University of Chicago Press).

Hodgson, Geoffrey M. (2017) Wrong Turnings: How the Left Got Lost (Chicago: University of Chicago Press, forthcoming).

Keane, John (1995) Tom Paine: A Political Life (London: Bloomsbury).

Keynes, John Maynard (1936) The General Theory of Employment, Interest and Money (London: Macmillan).

McCloskey, Deirdre Nansen (2017) ‘Nationalism and Socialism Are Very Bad Ideas: But liberalism is a good one’, Reason.Com, February. http://reason.com/archives/2017/01/26/three-big-ideas

Monbiot, George (2016) ‘Neoliberalism – the ideology at the root of all our problems’, The Guardian, 15 April. https://www.theguardian.com/books/2016/apr/15/neoliberalism-ideology-problem-george-monbiot.

Townshend, Jules (1990) J. A. Hobson (Manchester: Manchester University Press).

Venugopal, Rajesh (2015) ‘Neoliberalism as a Concept’, Economy and Society, 44(2), pp. 165-87. http://www.tandfonline.com/doi/abs/10.1080/03085147.2015.1013356.

Posted in Brexit, Common ownership, Democracy, Donald Trump, Immigration, Karl Marx, Labour Party, Left politics, Liberalism, Markets, Nationalization, Politics, Populism, Private enterprise, Right politics, Socialism

November 18th, 2016 by geoffhodgson1946

Geoffrey M. Hodgson

“One of the most important essays you will read in 2016” @Rokewood

What caused the election of Donald Trump? I am deeply dissatisfied by some of the quick answers to this question.

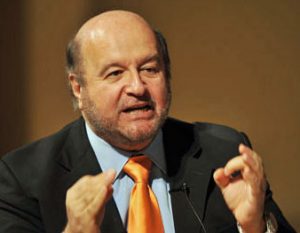

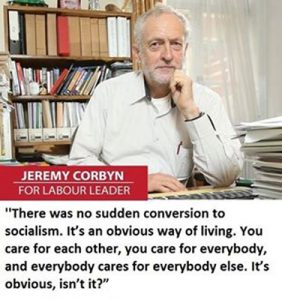

The leader of Her Majesty’s Opposition had an instant answer. Jeremy Corbyn blamed the left’s association “with the forces of globalisation during the Obama administration”. Instead, he insisted, we need to reject “that free market, economic thinking, which processed deindustrialisation in Britain”.

Naomi Klein

Others used different words on the same “free market” theme. Naomi Klein put it bluntly: “the force most responsible” for Trump’s success was “neoliberalism”. This worldview, “fully embodied by Hillary Clinton and her machine”, was “no match for Trump-style extremism.”

Trump won over US voters because: “Under neoliberal policies of deregulation, privatisation, austerity and corporate trade, their living standards have declined precipitously.”

The Guardian columnist George Monbiot followed with a historical piece, claiming that “the events that led to Donald Trump’s election started in England in 1975”, when Margaret Thatcher embraced the free-market “neoliberal” philosophy of Friedrich Hayek. This was a harbinger of the global rise of free-market thinking that allegedly wrought havoc in recent years.

Both Klein and Monbiot argue that Trump capitalised on the failure of other politicians to deal with the adverse effects of neoliberalism.

There is no doubt that the global expansion of capitalism in recent decades has been hugely disruptive, shifting millions of manufacturing jobs to East Asia. In the absence of adequate retraining and investment, it has led to declining opportunities for large swathes of the working population in North America and Europe.

Trump tapped into working class discontent. In important respects his policies are not neoliberal, by any reasonable definition of that term. In his campaign, Trump used anti-neoliberal, protectionist slogans such as high import tariffs and closed borders.

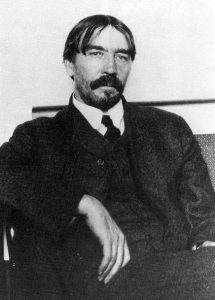

George Monbiot

But why did it take so long for people to react to “neoliberalism” and vote in this way? As Monbiot argued, the current so-called “neoliberalism” got under way in the 1970s. It accelerated after the beginning of economic reform in China in 1978 and after the fall of the Berlin Wall in1989. The whole world was then opened up for trade.

But while right-populist movements had emerged, they were then far from power. Tony Blair won a landslide election in 1997 and increased public spending on welfare, education and health. Three years after Blair had won a third election, the United States elected its first black President.

If neoliberalism and stagnant living standards had been around since the 1970s, then why did it take 40 years for a Trump-like demagogue to be elected? The political wind swung decisively to the right more recently, after the Great Crash of 2008.

But it is also difficult to explain Trump’s populist success as a targeted reaction to the financial crash. The removal of some banking regulations, by Bill Clinton in the US and Gordon Brown in the UK, did exacerbate the lending boom that led to the crash of 2008.

Yet, despite his protectionism, Trump offers still more deregulation. He is not targeting the bankers as part of the “elite”. On the contrary, he has pledged to repeal the Dodd-Frank Act, which was designed to curb some of the excesses of the financial sector. As Larry Elliott put it: “This looks curious for someone trying to surf a tidal wave of populist anger against the bankers.”

Putting the blame on “neoliberalism” underestimates the way in which outsiders such as Trump and Farage have created populist movements that blame “the elite” and offer simplistic solutions, such as to “curb immigration”. Blaming “neoliberalism” underestimates the pernicious influences of racism and anti-Muslim prejudice. Simplistic economic explanations of Trump’s victory ignore much stronger evidence of other factors at work.

Putting the blame on “neoliberalism” underestimates the way in which outsiders such as Trump and Farage have created populist movements that blame “the elite” and offer simplistic solutions, such as to “curb immigration”. Blaming “neoliberalism” underestimates the pernicious influences of racism and anti-Muslim prejudice. Simplistic economic explanations of Trump’s victory ignore much stronger evidence of other factors at work.

The Pavlovian leftist response of blaming markets or “neoliberalism” for “all our problems” is far off the mark.

What is neoliberalism?

Monbiot is keen to identify “neoliberals” such as Hayek as the villains. According to Monbiot:

“Neoliberalism sees competition as the defining characteristic of human relations. … Tax and regulation should be minimised, public services should be privatised. The organisation of labour and collective bargaining by trade unions are portrayed as market distortions that impede the formation of a natural hierarchy of winners and losers. Inequality is recast as virtuous: a reward for utility and a generator of wealth, which trickles down to enrich everyone.”

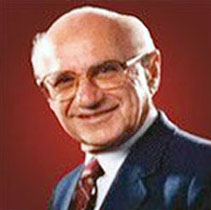

I shall pass over the many flaws in the essay from which the above passage is quoted. Monbiot conflates the different views of Ludwig von Mises, Friedrich Hayek and Milton Friedman, and he is inaccurate on several details. Note also that Monbiot does not highlight deregulation of the financial sector in this passage.

After taking on board Monbiot’s definition of neoliberalism, let us consider the extent to which it has been achieved in the real world.

Has neoliberalism been achieved in practice?

Monbiot described how in the 1970s “elements of neoliberalism, especially its prescriptions for monetary policy, were adopted by Jimmy Carter’s administration in the US and Jim Callaghan’s government in Britain.” He is unclear on the details, but presumably in part he refers to Callaghan’s embrace of monetarist ideas from 1976 to 1979.

Milton Friedman

Monetarism, incidentally, is not obviously the same as neoliberalism. While monetarists such as Friedman were free-marketeers, monetarism’s central claim is that the main cause of inflation is the rise in the money supply – a thesis that (as Friedman himself recognised) could also apply to a planned economy. Indeed, this central monetarist tenet was adopted by some Marxist economists.

“After Margaret Thatcher and Ronald Reagan took power, the rest of the [neoliberal] package soon followed: massive tax cuts for the rich, the crushing of trade unions, deregulation, privatisation, outsourcing and competition in public services.”

He is right. Albeit to different degrees in different countries, these things happened.

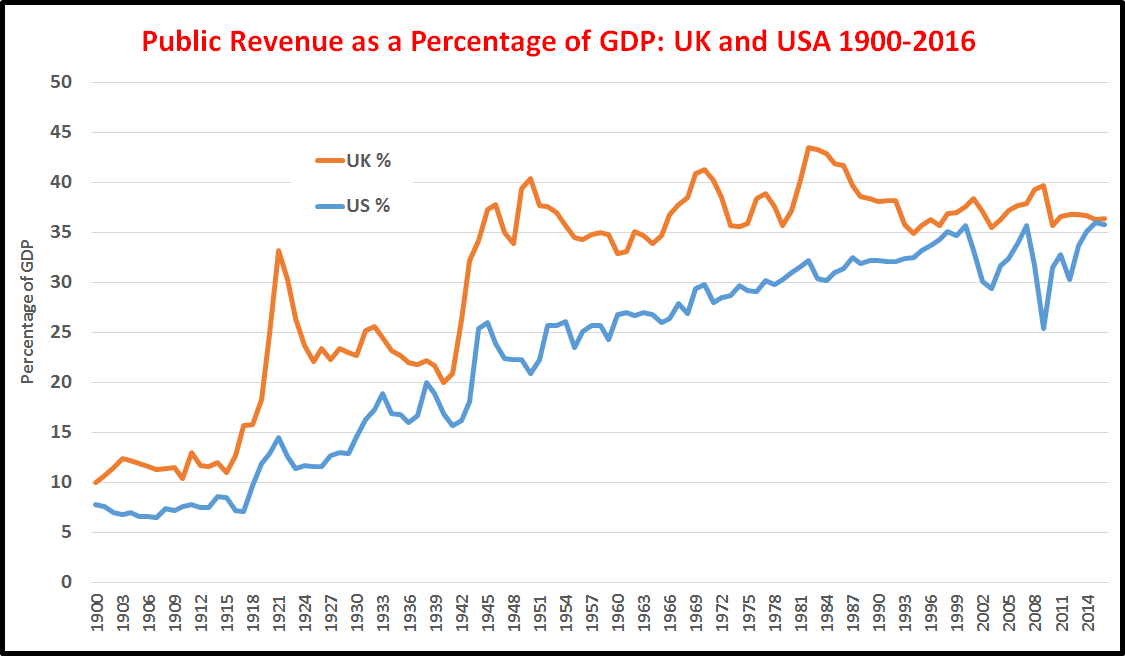

But go back to Monbiot’s checklist definition of neoliberalism, as quoted above. He saw neoliberalism as minimising “tax” not simply “tax cuts for the rich”. Has this happened?

Ronald Reagan & Margaret Thatcher

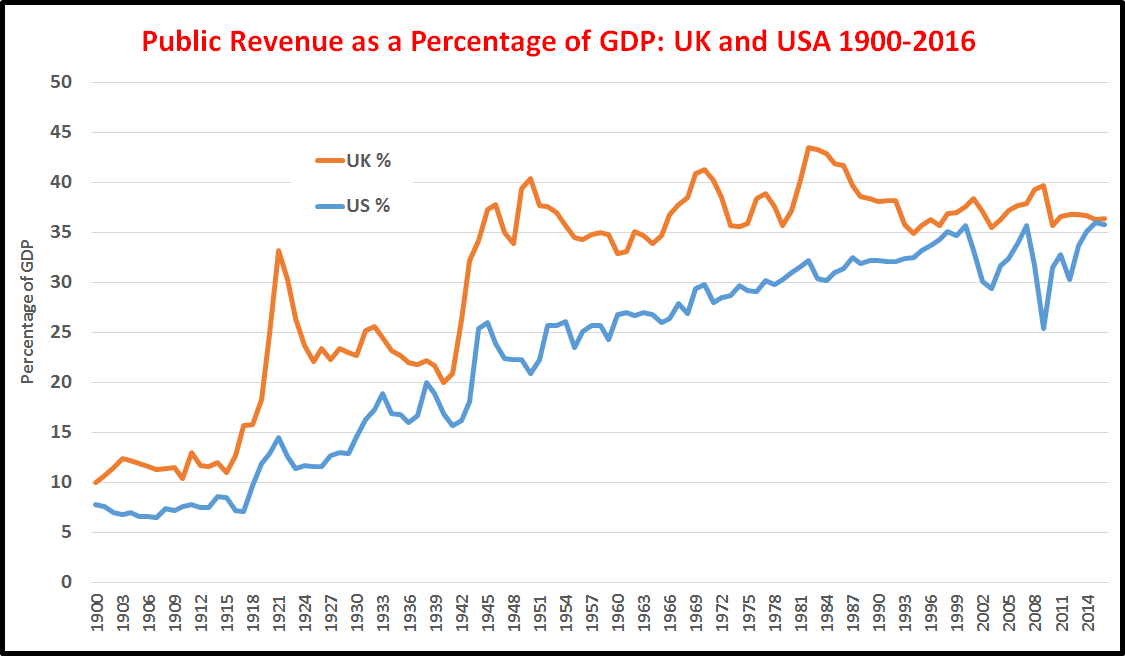

Margaret Thatcher reduced taxation for the rich. But the overall tax burden (all taxes as a percentage of GDP) rose during her period of office. This figure fell in the 1990s and has fluctuated from 1997 in a range between 35 per cent and 38 per cent of GDP. The UK austerity governments since 2010 have not reduced the overall tax take significantly.

Similarly, Ronald Reagan began by cutting income taxes for the rich, but ended his eight-year term of office with a Federal percentage tax take almost identical to that of his predecessor Jimmy Carter, and slightly above the average for the entire 1970-2009 period.

The “neoliberal” mission of massive overall tax cuts was not achieved under Thatcher or Reagan, or under subsequent administrations. Put in a longer historical perspective, taxation and public spending in the UK and USA today are much higher than they were before the Second World War.

The above figure shows the tax revenues, from national, state and local government combined, for the UK and the USA from 1900 to 2016. The alleged era of “neoliberalism” from the 1970s has not been associated with declining tax revenues. If anything, the “neoliberal” era of a minimal state was pre 1914, not post-1975.

What is characteristic of fiscal policy in the UK and USA is not the alleged “neoliberal” overall reduction of taxation but a lightening of taxation on the rich, and a failure to redistribute sufficiently, in the face of widening inequality.

Klein is probably right to suggest: “A good chunk of Trump’s support could be peeled away if there were a genuine redistributive agenda on the table.” But she, with Corbyn and Monbiot, are wrong to chime in with the crude anti-market mantras that have disabled the Left for 180 years. In building a redistributive agenda we must look to Thomas Paine, rather than Robert Owen or Karl Marx.

Privatisation: against dogma

By contrast, Monbiot’s other point, about growing privatisation since the 1970s, has been borne out by the evidence. In the UK, USA and much of the world there has been massive privatisation and outsourcing of public services.

Unlike any false claim that “neoliberalism” has reduced overall taxes, the increase of privatisation is manifest. In addition, it has sometimes led to deleterious consequences including lower pay for workers and a reduced quality of services.

Unlike any false claim that “neoliberalism” has reduced overall taxes, the increase of privatisation is manifest. In addition, it has sometimes led to deleterious consequences including lower pay for workers and a reduced quality of services.

But Corbyn and Monbiot speak and write as if privatisation is necessarily bad – always and everywhere it is seen as a negative policy. This doctrinaire stance simply inverts the claim of the crudest free marketeers, who claim that state provision is always bad and that private provision is always good. The Corbyn-Monbiot stance simply turns this upside-down. It is equally dogmatic. It is based on ideology, not evidence.

Regarding markets as always bad, amounts to agoraphobia or fear of markets (from the Greek words agora for market, and phobia for fear). This is an inversion of the kratophobia of the free-marketeers – a fear of government or of the state.

Instead of these ideologically-driven, simplistic positions, it is necessary to be more pragmatic. Some privatisations work. Others do not. Some state provision is effective. Some is wasteful and inefficient. We need to look at individual cases to understand why.

There are many case studies to look at and they are too wide-ranging to be reviewed here. A good start would be to look at an important early article on privatisation by John Goodman and Gary Loveman in the Harvard Business Review. They wrote:

“the issue is not simply whether ownership is private or public. Rather, the key question is under what conditions will managers be more likely to act in the public’s interest … managerial accountability to the public’s interest is what counts most, not the form of ownership.”

Goodman and Loveman argued that profits and the public interest overlap best when the privatised organisation is in a competitive market. Competition from other companies can discipline managerial behaviour. Consequently, there is little point in privatisation if competition is lacking.

Subsequent research has shown that other factors are involved as well. Instead of being driven by dogma, we need to be pragmatic and experimental, taking account of research.

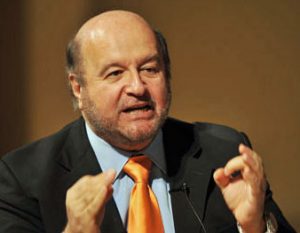

Jeremy Corbyn

You may respond that Corbyn is pragmatic, because he has declared that he is in favour of a mixed economy: he accepts a private as well as a public sector. But notice the imbalance in his presentations. He treats public provision as ideal, and the private sector as an expedient to be tolerated, at least for a while.

Corbyn says he accepts a mixed economy, but he has offered has no defence of private sector. His “mixed economy” could be a stopping point on the road to a fully-socialist planned economy, where private enterprise is pushed to the side-lines.

Declining public provision?

Ken Loach’s moving film, I, Daniel Blake, portrays the heart-breaking human consequences of the UK Conservative government’s shredding of the welfare safety net for the poor. Attempts to reduce public spending in many countries have led to millions of human tragedies like this.

Ken Loach’s moving film, I, Daniel Blake, portrays the heart-breaking human consequences of the UK Conservative government’s shredding of the welfare safety net for the poor. Attempts to reduce public spending in many countries have led to millions of human tragedies like this.

Doctrinaire austerity policies – which fail in their own terms because they depress economic demand for goods and services and create more unemployment – have been adopted by many governments and imposed by the European Union.

All this is real, and tragic. Millions have suffered because of such misguided policies. But we should not jump to the conclusion that “neoliberalism” has been successful in moving toward a minimal economic role for the state.

All this is real, and tragic. Millions have suffered because of such misguided policies. But we should not jump to the conclusion that “neoliberalism” has been successful in moving toward a minimal economic role for the state.

In my book Conceptualizing Capitalism I examined differences and changes in public social spending in different developed countries from 1980 to 2005, using OECD data. The principal components of public social spending include health services, old age benefits, unemployment benefits, incapacity-related benefits, family support, active labour market public programs, and housing benefits.

Amounts of public spending as percentages of GDP (in 1980 and 2005) are shown below.

|

1980 |

2005 |

change |

| Australia |

10.3 |

16.5 |

+6.2 |

| Austria |

22.4 |

27.1 |

+4.7 |

| Belgium |

23.5 |

26.5 |

+3.0 |

| Canada |

13.7 |

16.9 |

+3.2 |

| Denmark |

24.8 |

27.7 |

+2.9 |

| Finland |

18.1 |

26.2 |

+8.1 |

| France |

20.8 |

30.1 |

+9.3 |

| Germany |

22.1 |

27.3 |

+5.2 |

| Italy |

18.0 |

24.9 |

+6.9 |

| Japan |

10.2 |

18.5 |

+8.3 |

| Netherlands |

24.8 |

20.7 |

–4.1 |

| Norway |

16.9 |

21.6 |

+4.7 |

| Portugal |

9.9 |

23.0 |

+13.1 |

| Spain |

15.5 |

21.1 |

+5.6 |

| Sweden |

27.1 |

29.1 |

+2.0 |

| Switzerland |

13.8 |

20.2 |

+6.4 |

| UK |

16.5 |

20.5 |

+4.0 |

| US |

13.2 |

16.0 |

+2.8 |

Public Social Spending as Percentage of GDP in Selected Countries

Most countries increased their public social spending, during a period when the ideology of privatization was resurgent. The Netherlands is an exception. Note that the increases in public social spending are not explained by rises in unemployment benefit, because generally this comprises a small proportion of public social spending.

Of course, it needs to be emphasised that there is an ideologically-driven agenda that has led to deep cuts in some welfare and has been gravely damaging for the poor. But we are far from re-entering the era of the minimal state.

Pursuing unicorns

Much of the hysteria against “neoliberalism” draws from the Left’s deep rooted antipathy to markets. Let’s briefly address this.

First, they may be alternatives to markets in modern, large-scale economic systems but they would greatly out-do the miseries inflicted on the fictional Daniel Blake and his millions of real-world counterparts.

Karl Marx

Every attempt to get rid of markets, since Robert Owen and Karl Marx proclaimed their redundancy in the nineteenth century, has led to famine, repression and the termination of democracy. Look to Stalin’s Russia, Mao’s China, Cambodia, Cuba and Venezuela. Twentieth-century Communism resulted in over 90 million deaths.

In the light of twentieth-century experience it would be worse than foolhardy to make yet another attempt to minimise markets, or as Klein oddly put it, “corporate trade”.

A better way is possible, but it involves taming and supplementing markets, not repressing them. It means regulating corporations, not casting them as sorcerers of evil. But sadly, agoraphobia still afflicts many on the left.

“It seems to me that the questions we urgently need to ask ourselves are these: is totalitarianism the only means of eliminating capitalism? If so, and if … we abhor totalitarianism, can we continue to call ourselves anti-capitalists? If there is no humane and democratic answer to the question of what a world without capitalism would look like, then should we not abandon the pursuit of unicorns, and concentrate on capturing and taming the beast whose den we already inhabit?”

Excellent. But since then he has gone down the rocky road of blaming “neoliberalism” for “all our problems”. Without defending some role for private property or markets, he thereby allies himself with the many leftists who now describe anyone defending private property or markets as “neoliberal”.

Has Monbiot now abandoned the idea of taming the capitalist beast? Does he wish to kill it instead?

In April 2016 he wrote: “Every invocation of Lord Keynes is an admission of failure.” So he junked the best macroeconomic theory we have for limiting some of the excesses of capitalism. His grounds for doing so were these:

“Keynesianism works by stimulating consumer demand to promote economic growth. Consumer demand and economic growth are the motors of environmental destruction.”

John Maynard Keynes

Wrong. “Consumer demand and economic growth” can destroy the planet, but only if that demand and growth relate to non-renewable material resources. Much demand and growth in modern economies is for services. Intangible assets now make up much of corporate wealth. For example, there are demands for information and education, and such services are added to GDP. There is no necessary reason why economic growth in a modern information-rich economy should ruin the planet. Keynes is still relevant.

Those that have pursued unicorns have imagined that it is possible to design a better system than capitalism. Monbiot says the same, declaring that for the Left

“the central task should be to develop an economic Apollo programme, a conscious attempt to design a new system, tailored to the demands of the 21st century.”

This puts him in full, unicorn-chasing mode. One of the biggest mistakes by early socialists was to ignore the massive complexity of modern economic systems and attempt to “design a new system” at the behest of some utopian dreamer.

Instead, what is required is careful, incremental, experimental change, retaining the flexibility and devolved autonomy afforded by widespread private property. This autonomy allows for multiple experiments and deeper learning from mistakes.

While state intervention is necessary, no complete or adequate overall “design” is possible, because of the way much knowledge is irretrievably dispersed throughout the economy. The economies of the twenty-first century are more knowledge-intensive than those before. Hence the possibilities of comprehensive central planning or “design” are even more limited.

Neoliberalism and economic man

“as modern psychology and neuroscience make abundantly clear – human beings, by comparison with any other animals, are both remarkably social and remarkably unselfish. The atomisation and self-interested behaviour neoliberalism promotes run counter to much of what comprises human nature.”

The first sentence is valid and important. The second is simplistic. As I elaborate in my book From Pleasure Machines to Moral Communities, strong evidence from psychology, evolutionary biology and primatology shows that the picture of self-seeking “economic man”, which dominated mainstream economics until recently, is deeply flawed.

The first sentence is valid and important. The second is simplistic. As I elaborate in my book From Pleasure Machines to Moral Communities, strong evidence from psychology, evolutionary biology and primatology shows that the picture of self-seeking “economic man”, which dominated mainstream economics until recently, is deeply flawed.

But that does not mean that we can or should get rid of markets. Our capacities for cooperation evolved culturally and genetically because our ancestors hunted and foraged in groups, rarely numbering more than 200 individuals, for millions of years. Relying on emotions and facial expressions, we developed sophisticated social mechanisms to engender trust and cooperation, and to enforce social rules.

As larger-scale cities emerged about 14,000 years ago, these face-to-face mechanisms could no longer be relied upon exclusively to regulate social interactions. Institutions such as law, property and contract were developed to deal with these more impersonal, non-familial, transactions.

Every human civilisation that has developed has relied on property, trade and contracts. These require different enforcement mechanisms, but they too require measures of trust and moral obligation, as Adam Smith made clear in his Theory of Moral Sentiments. The idea that markets inevitably corrode away all social ties is mistaken.

Even the Soviet-style economies of the twentieth century relied on some private property and trade. They failed because state bureaucracy stifled autonomy and innovation. China grew rapidly when it expanded the private sector after 1978.

Of course, the spread of the market would be detrimental if it invaded all our social relations, attempting to put prices on love and friendship and reducing everything else to money transactions. But a system of private property provides a degree of autonomy that is required to maintain non-market interactions at home and at work. Successful corporations create islands of cooperation and teamwork within their organisational boundaries.

Impersonal relations occur in bureaucracies as well as in markets. Large-scale systems of national planning also make much interaction impersonal. People become atomised; they become numbers, to be processed by bureaucrats and computers.

Impersonal relations occur in bureaucracies as well as in markets. Large-scale systems of national planning also make much interaction impersonal. People become atomised; they become numbers, to be processed by bureaucrats and computers.

The experience of centrally-planned economies in Russia, China and Eastern Europe shows that systems of state planning can be cesspits of human alienation and corruption, governed impersonally by disillusioned bureaucrats and corrupt state officials. I recommend the film The Lives of Others for a glimpse into that dark world.

Abandoning neoliberalism

I have written at further length elsewhere on the limits to markets. I accept Hayek’s explanation that comprehensive overall planning is dysfunctional. But I do not accept that everything should or can become a monetary transaction in its place.

Indeed, the growing use of information in a capitalist economy puts limits on the role of information as property. Furthermore, the very freedom of waged employees means that there are constraints on entering into contracts for future work. There are limited futures markets for labour. For such reasons, capitalism can never be a 100 per cent market system.

Hayek failed to acknowledge fully the limits to markets. Such free marketeers are the mirror-image of socialists who fail to acknowledge adequately that there are limits to common ownership. We have to transcend both agoraphobia and kratophobia.

Agoraphobics react adversely to any tolerance of markets. Hence economic interventionists such as Tony Blair, and supporters of public healthcare such as Hillary Clinton, have recently and frequently been accused of being neoliberals. This is misleading and absurd.

As Colin Talbot has pointed out, “neoliberalism” has become “a term of abuse” to be used against “any type of pro-market reform or political position that recognizes markets may – in the right circumstances – be a good thing”. Consequently, everyone “from moderate social democrats to the most lurid free-marketeers gets lumped together under a convenient ‘neoliberal’ label.”

In a brilliant survey of its usage since the 1980s, Rajesh Venugopal concluded that “neoliberalism has become a deeply problematic and incoherent term that has multiple and contradictory meanings, and thus has diminished analytical value.”

Some may wish to retain the “neoliberal” label, to apply it to those free marketeers who attempt to shrink radically the size of the state, and to privatise anything that walks. The definition could be further sharpened by adding advocacy of economic austerity. It could also could be sharpened by including deregulation of the financial sector.

But such nuances have been lost in a global storm of “neoliberal” accusations. Klein and Monbiot have added some force and authority to this widening tempest.

But such nuances have been lost in a global storm of “neoliberal” accusations. Klein and Monbiot have added some force and authority to this widening tempest.

They do not confine their accusations to the likes of Hayek. Most seriously, they pointed the “neoliberal” finger at Hillary and Bill Clinton, as Corbyn made the “forces of globalisation” jibe at Barack Obama.

If it means anything, neoliberalism is an ideology and only partly a reality. Austerity and welfare cuts have wreaked havoc, but markets and private enterprise have lifted millions out of poverty. Agoraphobic accusations of “neoliberalism” miss the latter point.

“Neoliberalism” gave us Trump

We may ask: what part did the accusers of “neoliberalism” have to play in Trump’s victory? The constant tainting of Hillary Clinton as a “neoliberal” may have helped to persuade many Democratic supporters to stay at home. We know from the data that the below-par turnout by Democrats – especially by the young – was decisive in losing those swing states.

Tainting Hillary Clinton as a “neoliberal” could have played a part in clinching Trump’s success. If so, “neoliberalism” gave us Trump, but not in the way that Klein and Monbiot suggest.

18 November 2016

Minor edits – 19, 25, 30 November, 15, 28 December 2016

|

My forthcoming book elaborates on some of the political issues raised in this blog:

Wrong Turnings: How the Left Got Lost

To be published by University of Chicago Press in November 2017

|

Bibliography

BBC News (2016) ‘Jeremy Corbyn outlines Labour’s vision of a “new economics”’, 21 May. http://www.bbc.com/news/uk-politics-36351149.

Chantrill, Chrisopher (2016a) ‘UK Public Revenue’. http://www.ukpublicrevenue.co.uk/uk_national_revenue_analysis

Chantrill, Chrisopher (2016b) ‘US Government Revenue’. http://www.usgovernmentrevenue.com/revenue_history

Elgot, Jessica (2016) ‘Corbyn backs reduction of NATO presence along Russia’s borders’, The Guardian, 13 November. https://www.theguardian.com/politics/2016/nov/13/jeremy-corbyn-hints-at-reducing-nato-presence-russia-putin?CMP=share_btn_tw.

Elliott, Larry (2016) ‘Trump’s economic view is far from neoliberal, but it rides a populist wave’, The Guardian, 31 July. https://www.theguardian.com/business/2016/jul/31/trumps-economic-view-is-far-from-neoliberal-but-it-rides-a-populist-wave.

Goodman, John B. and Loveman, Gary W. (1991) ‘Does privatization serve the public interest?’ Harvard Business Review, November-December. https://hbr.org/1991/11/does-privatization-serve-the-public-interest.

Hodgson, Geoffrey M. (2013) From Pleasure Machines to Moral Communities: An Evolutionary Economics without Homo Economicus (Chicago: University of Chicago Press).

Hodgson, Geoffrey M. (2015) Conceptualizing Capitalism: Institutions, Evolution, Future (Chicago: University of Chicago Press).

Hodgson, Geoffrey M. (2017) Wrong Turnings: How the Left Got Lost (Chicago: University of Chicago Press, forthcoming).

Johnson, Christopher (1991) The Economy under Mrs Thatcher (Harmondsworth: Penguin).

Klein, Naomi (2016) ‘It was the Democrat’s embrace of neoliberalism that won it for Trump’, The Guardian, 9 November. https://www.theguardian.com/commentisfree/2016/nov/09/rise-of-the-davos-class-sealed-americas-fate.

Monbiot, George (2003) ‘Rattling the Bars’, The Guardian, 18 November. See http://www.monbiot.com/2003/11/18/rattling-the-bars/.

Monbiot, George (2016a) ‘Neoliberalism – the ideology at the root of all our problems’, The Guardian, 15 April. https://www.theguardian.com/books/2016/apr/15/neoliberalism-ideology-problem-george-monbiot.

Monbiot, George (2016b) ‘Neoliberalism: the deep story that lies beneath Donald Trump’s triumph’, The Guardian, 14 November. https://www.theguardian.com/commentisfree/2016/nov/14/neoliberalsim-donald-trump-george-monbiot.

O’Hara, Glen (2016) ‘Stop saying that Trumpism is about economics’, 15 November. http://publicpolicypast.blogspot.co.za/2016/11/stop-saying-that-trumpism-is-about.html.

Pagano, Ugo (2014) ‘The Crisis of Intellectual Monopoly Capitalism’, Cambridge Journal of Economics, 38(6), November, pp. 1409-29. http://cje.oxfordjournals.org/content/early/2014/08/04/cje.beu025.

Sahadi, Jeanne (2010) ‘Taxes: What people forget about Reagan’, CNN Money, 12 September. http://money.cnn.com/2010/09/08/news/economy/reagan_years_taxes/.

Talbot, Colin (2016) ‘The myth of neoliberalism’, 31 August. https://colinrtalbot.wordpress.com/2016/08/31/the-myth-of-neoliberalism/.

Velasco, Andrès (2016) ‘The Real Roots of Populism’, Project Syndicate, 28 July. https://www.project-syndicate.org/commentary/real-roots-of-populism-by-andres-velasco-2016-07?backaction=

Venugopal, Rajesh (2015) ‘Neoliberalism as a Concept’, Economy and Society, 44(2), pp. 165-87. http://www.tandfonline.com/doi/abs/10.1080/03085147.2015.1013356.

Posted in Common ownership, Donald Trump, George Monbiot, Jeremy Corbyn, Karl Marx, Left politics, Liberalism, Markets, Naomi Klein, Nationalization, Populism, Private enterprise, Right politics, Tony Blair, Uncategorized

November 4th, 2016 by geoffhodgson1946

Geoffrey M. Hodgson

Property is a key concept. It is central to major ideological debates in politics and to much analysis in the social sciences.

Libertarians such as Nobel Laureate Milton Friedman, Nobel Laureate Friedrich Hayek and the leading Austrian economist Ludwig von Mises argued that the protection of private property is a vital condition for economic prosperity and individual liberty.

By contrast, socialists such as Robert Owen and Karl Marx called for the abolition of private property. They favoured the common ownership of the means of production, distribution and exchange.

But, despite their diametrically-opposed political views, key protagonists such as von Mises and Marx shared a similar, but deeply-flawed, understanding of the nature of property. Later economists have compounded this error, even in the so-called “economics of property rights”, as developed by Armen Alchian, Yoram Barzel and others.

This misunderstanding of the nature of property has major adverse consequences. Historical debates about the role of property rights in the development of capitalism have been impaired. Defective advice continues to be given to governments in developing countries, neglecting the way that property enmeshes with financial and state institutions.

Property as natural versus property as a historically-specific institution

Writers defending private property often argue that ownership is ubiquitous, not simply among early humans but also in other species. Animals compete, as either individuals or groups, over territory. Psychologists provide evidence of deeply rooted feelings concerning possession among human infants. So it is claimed that notions of property are enduring and hard-wired into the neuro-systems of humans and other animals.

But feelings of possession are not the same thing as rights to property. The psychologist Lawrence Kohlberg pioneered the study of how individual humans develop an understanding of justice and morality from birth to adulthood.

But feelings of possession are not the same thing as rights to property. The psychologist Lawrence Kohlberg pioneered the study of how individual humans develop an understanding of justice and morality from birth to adulthood.

He and his colleagues demonstrated that it takes young humans a long time to distinguish between “I want X” or “X is mine”, on the one hand, and “I have a moral right to X”, on the other.

Similarly, the leading legal theorist Antony Honoré wrote in a classic article on ownership:

Antony Honoré

“To have worked out the notion of ‘having a right to’ as distinct from merely ‘having’ … was a major intellectual achievement. Without it society would have been impossible.”

Brute possession differs from moral or legitimate rights. But as Kohlberg lamented, some people grow up and never understand the difference.

If Marx or von Mises did grow up to learn the difference, then they made very little use of it in their writings.

Take von Mises first. He wanted to develop a theory of human action that would apply to the entire lifetime of our species. So, for example, von Mises’s concept of “exchange” is not limited to trade or contract over property, but applies to any form of human interaction, including the activities of Robinson Crusoe alone on his island.

Similarly, von Mises turned property into a concept that applies to all human history. When he considered property in his critical book on Socialism he put the brute fact of de facto control first:

“ownership is the having of the goods … This having may be called the natural or original ownership, as it is purely a physical relationship of man to the goods, independent of social relations between men or of a legal order.”

So does law have any place in our understanding of property? Von Mises continued:

“Economically … the natural having alone is relevant, and the economic significance of the legal should have lies only in the support it lends to the acquisition, the maintenance, and the regaining of the natural having.”

Hence, for von Mises, ownership was natural, asocial and ahistorical rather than legal or institutional. It was about “having” or possession. He downgraded the institutions required for the legitimation, protection and enforcement of the capacity to have, and neglected social aspects of ownership that may signal power or status.

Marx’s concept of property

Marx differed from von Mises, and not simply because he wanted to abolish private property. Marx also insisted that capitalist phenomena, including commodity exchange and markets, were historically specific and had not existed for all time.

But Marx’s concept of property was almost as broad as that of von Mises. Both concentrated on raw physical power over objects, rather than legal rights. Marx’s numerous discussions of “property” had little to say about legal rights, and he too conflated property with possession.

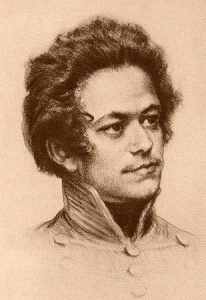

Karl Marx as a Young Man

Hence Marx in 1844 addressed “private property” and argued that “an object is only ours when we have it – … when we directly possess, eat, drink, wear, inhabit it, etc., – in short, when we use it.”

The distinction between property and possession was central to Pierre Joseph Proudhon’s famous 1840 book What is Property? Marx stridently criticized Proudhon’s work. But he paid little heed to its central distinction between possession and property.

With both Marx and von Mises, effective power over something, took priority over any legal or moral right. Legal and moral aspects of property were overshadowed.

While von Mises emphasized ownership by individuals, Marx defined social classes in terms of “property relations”, referring to what class controlled, and what class did not control, the means of production. Where von Mises stressed individuals, Marx stressed social classes. But for both of them it was a matter of control or possession.

Marx also claimed that tribal and hunter-gatherer societies owned “property” in common. This was “primitive communism”.

Thorstein Veblen

In response, the American institutional economist Thorstein Veblen argued convincingly in an 1898 essay that ownership and property were later institutional developments: “no concept of ownership, either communal or individual, applies in the primitive community. The idea of communal ownership is of a relatively later growth.”

This rightly implies that property means more than mere possession. Property requires historically specific institutions that did not exist in tribal societies. Property requires law and a state.

While the distinction between possession and property is ignored by Marxists and most modern economists, it is of supreme analytical and practical significance. It is impossible to understand capitalism in terms of mere possession, without an adequate conception of property.

Property: taking the law into account

Both Marx and von Mises put law on the surface of a more fundamental reality beneath: law was part of the “superstructure”, as Marx put it. More fundamental for both of them were brute powers of possession or control. For Marx, law simply “mirrored” those basic powers. For von Mises, law was relevant only insofar as it strengthened that physical control. For both of them, everything concerning property boiled down to control.

Different types of property right include the right to use a tangible or intangible asset (usus), the right to appropriate the returns from the asset (usus fructus), the right to change a good in substance or location (abusus), the right to the capital derived from the use of the good as collateral, the right to sell a good (alienation), and several other rights or limitations.

Note first that the legal right to control or use (usus) is only one of several legal types of right relating to property. By focusing on control, Marx and von Mises missed other important aspects of property.

Why is this important? Crucially for the functioning of capitalism, durable and alienable property can be used by its owner as collateral. Everyone who has a mortgage uses their property to obtain a loan. Entrepreneurs use their property to raise money to invest in their business.

Hernando de Soto

Consequently, as Hernando De Soto has argued, the registration of much property – particularly land and buildings – with recorded means to identify both property and owners, are crucial institutional mechanisms for economic development: they enable the use of such property as collateral for loans.

But this is not straightforward, precisely because property requires a satisfactory legal system and an effective state administration.

Another problem with the views of Marx and von Mises on property is their implicit understanding of human motivation. Both neglect our propensities to obey the law – as long as we regard it as legitimate – even if it does no otherwise align with our other goals.

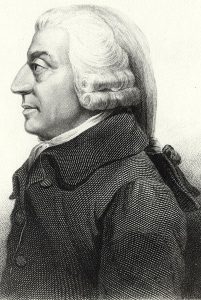

Adam Smith

Consequently, as Adam Smith pointed out long ago, the administration and perception of justice is vital for a properly-functioning market economy. Without a perception of legitimacy in the legal arrangements, the institutional order of commercial life would break down. This theme is present in both his Theory of Moral Sentiments and his Wealth of Nations.

In modern, complex societies, law helps to constitute many social structures and to configure relations of power. Law is not simply super-structural or reflective. Along with others, I have described this approach as legal institutionalism. It builds on the works of earlier writers, including the American institutional economist John R. Commons.

Property rights and Chinese economic development

Arguments emphasising the perceived legitimacy of the legal system have implications for establishing the rule of (state) law, and particularly for installing just and secure property rights to help promote economic development.

China is an important test case for these arguments. China began its market reforms in 1978 and grew rapidly thereafter. But its systems of property, commercial and corporate law are still relatively underdeveloped compared to Europe or North America.

This fact, alongside its highly impressive economic growth since 1978, has led some prominent economists – including Nobel Laureate Joseph Stiglitz – to conclude that legally-enforced property rights are of lesser significance.

But, despite superficial appearances to the contrary, there is evidence that legal systems and legal property rights matter. China’s explosive growth started when land-use (usus fructus) rights were widely conceded to the peasants after 1978. Local power from below tentatively established de facto powers, which spread widely and became de jure when they were legally ratified by the state.

But, despite superficial appearances to the contrary, there is evidence that legal systems and legal property rights matter. China’s explosive growth started when land-use (usus fructus) rights were widely conceded to the peasants after 1978. Local power from below tentatively established de facto powers, which spread widely and became de jure when they were legally ratified by the state.

But this does not mean that the legal ratification of land-use rights was unimportant. This endorsement, along with the institutional arrangements established from below, was vital to safeguard these rights. In addition, it was part of the development of a legal system which was necessary for any modern private enterprise economy.

Legalities matter, and evidence suggests that they matter still more as capitalism develops. There is strong evidence that economic growth is correlated with the rule of law, among other factors. As Francis Fukuyama put it: “The absence of the rule of law is indeed one of the principal reasons why poor countries can’t achieve high rates of growth.”

If China is to grow still further – into the ranks of middle-income countries – then it must pay attention to the reform and development of its legal system.

The exclusive focus on control overlooks the use of property as collateral for loans. The possibility of collateralization – which relies on legal and financial institutions – cannot be derived from possession alone. Further property rights involve institutions – relations between individuals as well as relations between individuals and things. They involve the state and law – not simply relations of control between social classes.

1688 and all that

These points are significant for an important ongoing debate on the causes of the rise of capitalism in Britain in the eighteenth century.

William of Orange 1688

In a famous 1989 paper, Nobel Laureate Douglass North and Barry Weingast argued that the key event was the Glorious Revolution of 1688, when William of Orange invaded and became king in the place of James II.

North and Weingast argued that the consequent settlement between king and parliament made property more secure and prompted the development of commerce, leading to the start of the Industrial Revolution in roughly about 1760.

The first major problem with this argument is that property rights in land in England were relatively secure from the thirteenth century. There was no major change in these circumstances in the years immediately following 1688. The foremost problem was not the security of this property but the feudal nature of property rights in land, which severely restricted its possible sale and use as collateral.

Douglass C. North

A second major problem is that over seventy years elapsed from 1688 to the beginning of the Industrial Revolution. If institutional changes relating to property after 1688 were so important, then why did they take so long to take effect? Economic growth in the 25 years after 1688 was no greater than in the preceding 25 years. Why was the take-off delayed for so long?

In my paper “1688 and all that” I offer a solution to this problem, based on a richer concept of property. The immediate effect of 1688 was to change England’s European alliances and to plunge the country into a series of wide-ranging wars, particularly against France and Spain.

The 1689 accord between King and Parliament made possible major changes in state administration and financial institutions, so that money could be raised to fund these wars. Guided by a more powerful Parliament, this new financial system stimulated reforms to landed property rights, the growth of collateralizable property and saleable debt, and thus enabled the Industrial Revolution.

Data on reforms of property rights show that key changes accelerated in the 1750s, making more land usable as collateral, which could be used to finance industrial ventures. Institutional changes immediately following 1688 were less to do with property: instead there is clear evidence of an immediate growth in state administration and increasing tax revenues to finance wars. This process included the formation of the Bank of England in 1694 and the growth of financial markets. Statutory legislation in 1704 helped the development of markets for debt.

Conclusion: a different perspective

This analysis suggests that the building of a state administration, which can sustain a modern monetary system and secure the use of private property as collateral, is an important precondition of rapid economic growth. Hence a stress on the “security of property rights” would be insufficient in developing countries. For more effective policies for economic development, the nature of property, and its connection with finance and politics, have to be better understood.

Neither Marx nor von Mises were particularly helpful in this regard.

Why did von Mises downplay the role of the state in his conception of property? He did so because he believed that markets and contractual exchange could function with little or no help from the state.

Why did Marx downplay the role of the state in his conception of property? He did so because he understood the state as the means by which one dominant social class exercises power over another. Marx, like von Mises, did not appreciate that under capitalism state law is necessary to constitute basic institutions such as property and contract.

Von Mises wanted a market economy with a minimal state. Marx thought that after the proletariat gained power and socialism was established, then the state would eventually “wither away”. Despite their other big differences, in theory and practice, they both thought that a large-scale complex economy could function with a minimal state. To understand property as a core institution of capitalism we need to transcend both of them.

With an improved understanding of the nature of property, we need to analyse data on its functioning in the developing world. In economic history we need more empirical studies of the role of lending, collateral and finance, in the growth of business and innovation.

Researchers should arise from slumbering in the Marx-Mises bed and set to work.

4 November 2016

Minor edits – 5-7 November, 7 December 2016

|

This book by G. M. Hodgson elaborates on some of the political issues raised in this blog:

Wrong Turnings: How the Left Got Lost

Published by University of Chicago Press in January 2018

|

Bibliography

Commons, John R. (1924) Legal Foundations of Capitalism (New York: Macmillan).

De Soto, Hernando (2000) The Mystery of Capital: Why Capitalism Triumphs in the West and Fails Everywhere Else (New York: Basic Books).

Deakin, Simon, Gindis, David, Hodgson, Geoffrey M., Huang, Kainan and Pistor, Katharina (forthcoming) ‘Legal Institutionalism: Capitalism and the Constitutive Role of Law’, Journal of Comparative Economics, print forthcoming, published online.

Fukuyama, Francis (2011) The Origins of Political Order: From Prehuman Times to the French Revolution (London and New York: Profile Books and Farrar, Straus and Giroux).

Heinsohn, Gunnar and Steiger, Otto (2013) Ownership Economics: On the Foundations of Interest, Money, Markets, Business Cycles and Economic Development (London and New York: Routledge).

Hodgson, Geoffrey M. (2015) Conceptualizing Capitalism: Institutions, Evolution, Future (Chicago: University of Chicago Press).

Hodgson, Geoffrey M. (2015) ‘Much of the “Economics of Property Rights” Devalues Property and Legal Rights’, Journal of Institutional Economics, 11(4), December, pp. 683-709.

Hodgson, Geoffrey M. (2017) ‘1688 and All That: Property Rights, the Glorious Revoution and the Rise of British Capitalism’, Journal of Institutional Economics, 13(1), March, print forthcoming, available free (open access) online.

Hodgson, Geoffrey M. (2017) Wrong Turnings: How the Left Got Lost (Chicago: University of Chicago Press).

Honoré, Antony M. (1961) ‘Ownership’, in Guest, Anthony G. (ed.) (1961) Oxford Essays in Jurisprudence (Oxford: Oxford University Press), pp. 107-47. Reprinted in the Journal of Institutional Economics, 9(2), June 2013, pp. 227-55.

Kohlberg, Lawrence (1969) ‘Stage and Sequence – the Cognitive-Developmental Approach to Socialization’, in D. A. Goslin (ed.) (1969) Handbook of Socialization Theory and Research (Chicago: Rand McNally).

Marx, Karl (1975) Early Writings (Harmondsworth: Penguin).

Mises, Ludwig von (1981) Socialism: An Economic and Sociological Analysis, translated from the second (1932) German edition of von Mises’s Die Gemeinwirtschaft (Indianapolis: Liberty Classics).

Mises, Ludwig von (1949) Human Action: A Treatise on Economics (London and New Haven: William Hodge and Yale University Press).

North, Douglass C. and Weingast, Barry R. (1989) ‘Constitutions and Commitment: The Evolution of Institutions Governing Public Choice in Seventeenth-Century England’, Journal of Economic History, 49(4), December, pp. 803-32.

Proudhon, Pierre Joseph. (1890) What is Property? An Inquiry into the Principle of Right and Government, translated from the French edition of 1840 (New York: Humbold).

Smith, Adam (1759) The Theory of Moral Sentiments; or, An Essay Towards an Analysis of the Principles by which Men Naturally Judge Concerning the Conduct and Character, First of their Neighbours, and Afterwards of Themselves (London and Edinburgh: Millar, and Kincaid and Bell).

Smith, Adam (1776) An Inquiry into the Nature and Causes of the Wealth of Nations, 2 vols, (London: Strahan and Cadell).

Stiglitz, Joseph E. (1994) Whither Socialism? (Cambridge, MA: MIT Press).

Tyler, Tom R. (1990) Why People Obey the Law (New Haven: Yale University Press).

Veblen, Thorstein B. (1898) ‘The Beginnings of Ownership’, American Journal of Sociology, 4(3), November, pp. 352-65.

Posted in Common ownership, Karl Marx, Liberalism, Ludwig von Mises, Markets, Private enterprise, Property Tagged with: Property

August 10th, 2016 by geoffhodgson1946

Geoffrey M. Hodgson

‘This is a thundering good read’ – Peter Smith

‘The best article I’ve read for a while’ – Karen Bradley

‘Brilliant on why socialism isn’t “obvious”’ – Robbie Hudson

‘Very informative & sobering. Highly recommended’ – Jan Davies

One thing in British politics is very obvious: Jeremy Corbyn and his followers are very keen on something they call socialism. But this word has migrated in meaning since it first appeared in English in 1827. So it is reasonable to ask what they mean by it.

I’ve tried. I got lots of vague answers.

I fully appreciate that the Mirror is an unsuitable forum for a detailed account of the workings of the future socialist utopia, but unfortunately I have little else to go on. Apart from some gestures in favour of nationalization, and some sentimentality for the pre-Blair version of Labour’s Clause Four, I can find no fuller account of what Corbyn’s ‘socialism’ means.

Yet we are told twice (in one short quote) that it is ‘obvious’.

Here is my own confession: fifty years ago I believed that socialism was ‘obvious’. Eventually I was persuaded otherwise. Initially, it was not my growing awareness of the horrendous consequences of the socialist experiments in Russia, China and elsewhere that jolted me.

Here is my own confession: fifty years ago I believed that socialism was ‘obvious’. Eventually I was persuaded otherwise. Initially, it was not my growing awareness of the horrendous consequences of the socialist experiments in Russia, China and elsewhere that jolted me.

My comrades and I saw these deformations as unfortunate results of Stalinist bureaucracy plus Western hostility. We believed that a different, ‘democratic socialism’, was possible.

What persuaded me that socialism is not ‘obvious’ was a consideration of how such a system could work, in detail and in practice. How would production and distribution be organised? How would dispersed information concerning production and distribution be gathered and processed? How would resources be allocated? Who would decide? How would trillions of dispersed decisions be somehow processed by democratic committees? How would less-devoted workers be incentivized or persuaded to work harder or with greater attention to detail? What incentives would exist to encourage innovation and change, especially when everything had to be referred to some democratic council? And so on.

Once you begin to ask these difficult questions, socialism becomes much less ‘obvious’.

Numbers and incentives

Some version of socialism might work on a small scale. Cooperation can work in small groups, based on close, inter-personal interactions. Humans have co-operated in this way, in families and tribal units, for many thousands of years.

Nobel Laureate Elinor Ostrom studied the management of common-pool resources – such as medieval common land, fisheries or agricultural irrigation schemes – and showed how they can be effectively managed by relatively small local communities.

Nobel Laureate Elinor Ostrom studied the management of common-pool resources – such as medieval common land, fisheries or agricultural irrigation schemes – and showed how they can be effectively managed by relatively small local communities.

Their small size allows participants to monitor each other, to ensure that necessary tasks are carried out and that the interests of the community are served.

Enforcement mechanisms range from praise to punishment. Within these relatively small and cohesive groups, trust and targeted sanctions are mechanisms for encouraging cooperation, reciprocity and compliance with social rules.

But these mechanisms depend on a degree of familiarity with one another. Big problems emerge when we move from tribal to large-scale societies. These began to develop about twelve thousand years ago. Our natural and cultural dispositions to cooperate and to help one another had to be supplemented by other mechanisms.

In larger societies, face-to-face, trust-based mechanisms to sustain cooperation are relatively less effective. When we move from communities of a hundred or so, where it is possible for everyone to know everyone else, to communities of thousands or more, then interpersonal trust and reputation are much less successful with large-scale interactions, and they have to be supplement by other incentives and constraints.

The increase of scale can create incentive problems that can be overcome in smaller communities. Many socialist experiments involved collectivisation. But when thousands of people are brought together, and rewards are shared, then there is less incentive to make the extra effort, because the rewards from that additional work would be hugely diluted.

This problem was illustrated dramatically in China. After the Communist Revolution of 1949, agriculture was organized into large collective farms. Farmers had little incentive to improve productivity, other than by threats and bureaucratic bullying. Risky innovation was unwise. Productivity remained low and often there were shortages of food.

Mao Zedong died in 1976, opening up the possibility of reform. In 1978 some peasant farmers decided to withdraw from collective farms and take responsibility for production at the household level, where the household (instead of the collective) received the revenue from its sold output. Individual households had much greater incentives to work harder and to innovate.

After decades of slow growth under Mao, China’s explosive economic growth began with those changes in rural areas. As a result, unprecedented millions were lifted out of poverty. China’s spectacular economic growth began when agriculture began to pass into the private control of the peasants after 1978.

|

This book by G. M. Hodgson elaborates on some of the political issues raised in this blog:

Wrong Turnings: How the Left Got Lost

Published by University of Chicago Press in January 2018

|

While interpersonal interactions can engender cooperation on a small scale, and they continue to do so in families and small communities, in large-scale societies other mechanisms and incentives are necessary. Economic history teaches us that modern dynamic economies depend on markets, competition and a large private sector, as well as an effective state.

Corbyn is right: it is very important that we care for one another. But in terms of practical input, we cannot care equally for everyone. We can care more readily for those close to us, who we know well: our family, our friends and our workmates. But extending our caring to society as a whole becomes more of a political and less of a personal project. We need caring governments, but the practical extension of caring from the personal to the political is neither obvious nor easy.

Corbyn is right: it is very important that we care for one another. But in terms of practical input, we cannot care equally for everyone. We can care more readily for those close to us, who we know well: our family, our friends and our workmates. But extending our caring to society as a whole becomes more of a political and less of a personal project. We need caring governments, but the practical extension of caring from the personal to the political is neither obvious nor easy.

The need for countervailing power

A simplistic response would be to suggest that we elect a government that is staffed by well-meaning individuals. But to different degrees, almost everyone is corruptible. Even the uncorrupt have their own biased agendas and priorities.

There is a need for rules, monitoring and countervailing power. If all economic power is concentrated in the bureaucracy of planners, then will be no effective alternative power that can countervail.

There is a need for rules, monitoring and countervailing power. If all economic power is concentrated in the bureaucracy of planners, then will be no effective alternative power that can countervail.

Even if politicians are competent and well meaning – lots of them are – they still face the problems of dispersed knowledge and uncertainty in modern, large-scale, and highly complex economies.

Consequently, relatively little can be planned from the top. Solutions to real-world, nitty-gritty problems are rarely ‘obvious’. There is a need for both humility and experimentation. We need to try and see what works and learn from mistakes, rather that rushing headlong towards what seems obvious.

The survival of democracy depends on a dispersion of real economic and political power. A healthy, pluralist polity depends on a pluralist economy, with multiple centres of autonomous decision-making. This means a system of private enterprise, as well as a political system with checks, balances and power that can be held to account. The state can and must also play a vital role in the economy, but not to the extent that it smothers private enterprise and initiative.

There is a large and fascinating analytical literature on the problems involved in classical socialism, and I cite a few works on this below. There is not the space to go into it further here. These works are not all written by neoliberals. But intelligent neoliberals – despite their limitations – are often worth reading. Although there are disagreements on approach and detail, the general conclusion is that large-scale socialism cannot work effectively and democratically. This analytical conclusion is corroborated by the historical experience of stagnation in innovation in Soviet-style regimes.1

The ‘obvious’ roots of fanaticism and intolerance

The ‘obviousness’ of socialism empowers its supporters with enduring energy and even fanaticism. If socialism is ‘obvious’, how do we explain the failure of other intelligent people to get on board? If they are not stupid, then they must be acting out of personal malice or greed. They must have sold out their principles in some way. Or they are just plain nasty. When socialism is seen as ‘obvious’, its opponents are regarded as stupid or evil.

The perceived ‘obviousness’ of socialism fuels both fanaticism and intolerance. Because the solution to the problem is ‘obvious’, there can be no doubt. There is no need to experiment, to seek wise counsel, or to listen to critics. Those that deny the obvious are deluded, corrupted, or in the pay of those that gain from the existing system.

The great American politician Robert F. Kennedy once said:

The great American politician Robert F. Kennedy once said:

‘What is objectionable, what is dangerous about extremists is not that they are extreme, but that they are intolerant. The evil is not what they say about their cause, but what they say about their opponents.’

We have seen this elsewhere, in the brutal fanaticism of religious zealots, as well as in the murderous tragedies of twentieth-century socialism under Stalin and Mao. They all shared in common the absence of doubt, the certainty of redemption or victory, and the confidence in their own righteousness.

It is deeply saddening that the once-great British Labour Party has been taken over by people who think that their aims and long-term solutions are ‘obvious’. Once the zealots take over, there is no way back. The party is then trapped in a vicious circle.

A diminished vote in an election is a success because it is seen as a big vote for a purer socialism. When Labour lost the 1983 election on a socialist manifesto, with the lowest share of the vote since 1918, Tony Benn greeted the result as a triumph for socialist ideas.

Even small successes – such as winning elections to parish councils – feed frenzies of celebration. All acknowledged failures are blamed on others, such as the ‘mainstream media’ or the ‘traitors’ within.

Even small successes – such as winning elections to parish councils – feed frenzies of celebration. All acknowledged failures are blamed on others, such as the ‘mainstream media’ or the ‘traitors’ within.

With an ideology where no possible event can falsify the ‘obvious’, the doubters are purged. The wise give up. The fanatics win.2

Touting socialism as an ‘obvious’ solution empowers a fanaticism that can crush all traces of liberal tolerance, which is essential for democracy within any political party, as well as within the political system as a whole. Corbyn’s victory in the 2016 leadership election marks the point of no return for Labour. It is beyond the beginning of the end. Labour is now dying. Thoughtful radicals must go elsewhere.

10 August 2016

Minor edits – 11-13 August 2016

A version of this post was published in the i newspaper on 11 August.

More comments on this post:

‘A gloomy but sadly very acute and perceptive analysis’ – Helen Salmon

‘Definitely one of his best, and the best thing I’ve read all week’ – Tom Atkinson

‘Excellent article on the anti-democratic nature of seeing one’s views as “obvious”’ – Francis Hoar

‘Brilliant piece on why “obvious” socialism leads to intolerance (and doesn’t work either)’ – Colin Talbot

‘Thank you so much for your still small voice of reason: it is worth its weight in gold amid this chaos’ – Elizabeth Jones

End Notes

- A recent contribution of mine on the socialist calculation debate can be found here.

- After publication, Colin Williams kindly pointed out that the Russell quote that heads this post – although widely attributed to him and close to other similar quotes by Russell – cannot be found in this exact form in Russell’s works.

Bibliography

Hayek, Friedrich A. (1944) The Road to Serfdom (London: George Routledge).

Hodgson, Geoffrey M. (2015) Conceptualizing Capitalism: Institutions, Evolution, Future (Chicago: University of Chicago Press).

Lavoie, Donald (1985) Rivalry and Central Planning: The Socialist Calculation Debate Reconsidered (Cambridge: Cambridge University Press).

Mill, John Stuart (1859) On Liberty (London: John Parker & Son).

Nove, Alexander (1991) The Economics of Feasible Socialism Revisited (London: George Allen and Unwin).

Ostrom, Elinor (1990) Governing the Commons: The Evolution of Institutions for Collective Action (Cambridge: Cambridge University Press).

Steele, David Ramsay (1992) From Marx to Mises: Post-Capitalist Society and the Challenge of Economic Calculation (La Salle, Illinois: Open Court).